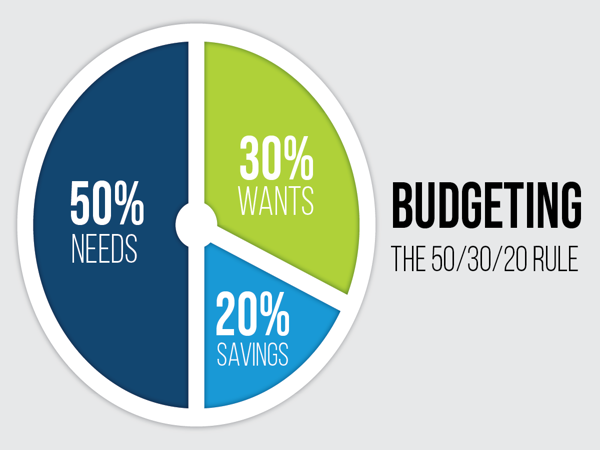

The 50/30/20 rule is a straightforward and effective budgeting framework that can help investors manage their finances, allocate resources efficiently, and ensure long-term financial stability. This rule is especially beneficial for those who seek a balanced approach to spending, saving, and investing. In this blog post, we will explore the principles of the 50/30/20 rule, explain how it works, provide examples and step-by-step solutions, and discuss best practices.

Understanding the 50/30/20 Rule

The 50/30/20 rule is a budgeting guideline that divides after-tax income into three categories:

- 50% for Needs: Essential expenses that are necessary for living.

- 30% for Wants: Discretionary spending on non-essential items.

- 20% for Savings and Investments: Savings, investments, and debt repayment.

Example: If your after-tax income is $4,000 per month, you would allocate:

- $2,000 (50%) for needs

- $1,200 (30%) for wants

- $800 (20%) for savings and investments

Breaking Down Each Category

- Needs (50%)

- Explanation: Needs are essential expenses required for day-to-day living and survival. These include housing, utilities, groceries, transportation, insurance, and healthcare.

- Step-by-Step Solution:

- List all your essential expenses.

- Calculate the total amount needed for these expenses each month.

- Ensure this amount does not exceed 50% of your after-tax income.

Example:

- Rent/Mortgage: $1,200

- Utilities: $200

- Groceries: $400

- Transportation: $150

- Insurance: $50

- Total: $2,000 (50% of $4,000)

- Wants (30%)

- Explanation: Wants are discretionary expenses that enhance your lifestyle but are not essential. These include dining out, entertainment, vacations, hobbies, and shopping.

- Step-by-Step Solution:

- Identify your discretionary expenses.

- Calculate the total amount spent on these items each month.

- Ensure this amount does not exceed 30% of your after-tax income.

Example:

- Dining Out: $300

- Entertainment: $200

- Vacations: $300

- Hobbies: $200

- Shopping: $200

- Total: $1,200 (30% of $4,000)

- Savings and Investments (20%)

- Explanation: This category includes contributions to savings accounts, retirement accounts, investments, and debt repayment. It is crucial for building financial security and wealth over time.

- Step-by-Step Solution:

- Determine your financial goals (e.g., emergency fund, retirement, down payment for a home).

- Allocate a portion of your income to these goals.

- Ensure this amount equals at least 20% of your after-tax income.

Example:

- Emergency Fund: $200

- Retirement Contributions: $300

- Investments: $200

- Debt Repayment: $100

- Total: $800 (20% of $4,000)

Best Practices for Implementing the 50/30/20 Rule

- Track Your Expenses

- Explanation: Keeping track of your expenses helps you stay within budget and identify areas for improvement.

- Best Practice: Use budgeting apps or spreadsheets to monitor your spending and make adjustments as needed.

- Automate Savings and Investments

- Explanation: Automating contributions to savings and investment accounts ensures consistency and reduces the temptation to spend.

- Best Practice: Set up automatic transfers from your checking account to your savings and investment accounts.

- Review and Adjust Regularly

- Explanation: Regularly reviewing your budget helps you stay on track and make necessary adjustments based on changes in income or expenses.

- Best Practice: Conduct monthly or quarterly budget reviews to assess your financial progress and make adjustments as needed.

- Prioritize High-Interest Debt

- Explanation: Paying off high-interest debt quickly can save you money in the long run and improve your financial health.

- Best Practice: Allocate a portion of your savings to pay down high-interest debt, such as credit card balances.

- Set Realistic Financial Goals

- Explanation: Setting achievable financial goals helps you stay motivated and focused on your financial journey.

- Best Practice: Break down long-term goals into smaller, manageable milestones and celebrate progress along the way.

How the 50/30/20 Rule Works for Investors

For investors, the 50/30/20 rule can provide a structured approach to managing finances and ensuring consistent contributions to investment accounts.

Example: An investor with an after-tax income of $5,000 per month would allocate:

- $2,500 (50%) for needs

- $1,500 (30%) for wants

- $1,000 (20%) for savings and investments

Step-by-Step Solution:

- Allocate to Needs: Cover essential living expenses such as housing, utilities, and groceries.

- Allocate to Wants: Set aside money for discretionary spending such as entertainment and dining out.

- Allocate to Savings and Investments: Contribute to investment accounts, retirement funds, and other savings goals.

By consistently following the 50/30/20 rule, investors can ensure a balanced approach to spending, saving, and investing, leading to long-term financial security and growth.

.jpg)